The journey to becoming a Chartered Financial Analyst (CFA) is a demanding one, and the first hurdle, CFA Level 1, requires a deep mastery of foundational investment concepts. While many suggest longer preparation periods, a strategic and intensely focused CFA Level 1 study plan can absolutely lead to success in just three months.

But this isn’t just about passing. It’s about excelling. This guide moves beyond generic schedules to provide a proven, expert-led strategy designed to place you in the top 10% of candidates. We’ll leverage a professional’s insights to craft a plan that builds deep knowledge, confidence, and a winning mindset.

Why Your CFA Level 1 Study Plan Should Aim for the Top 10%

Many candidates ask, “What’s the minimum passing score?” That’s the wrong question. We aren’t aiming for the thin red line of a pass; we are aiming for the 90th percentile. Why? Because top-tier performance on the exam isn’t just about luck; it’s the direct result of a superior strategy.

The goal is to consistently score above 70% in every single topic area. This level of mastery makes the passing score irrelevant and places you in an elite tier of candidates. A structured, intelligent plan is the only way to achieve this in a condensed 3-month timeframe. It turns the overwhelming into the achievable.

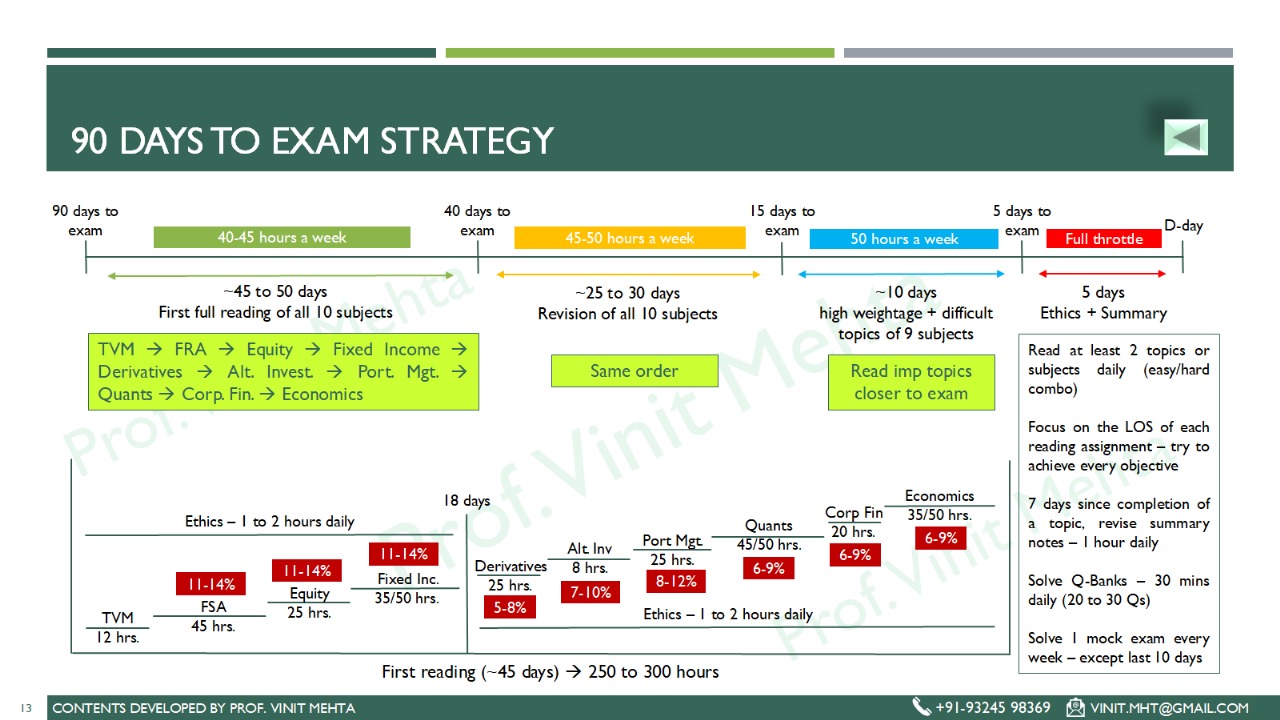

Your 3-Month CFA Structured Study Plan: A Bird's-Eye View

A successful 90-day campaign is built from the exam day, backward. By knowing what your final days look like, you can structure the preceding weeks with purpose.

Here is our three-phase battle plan:

- Phase 1: First Reading of All 10 Subjects (45 to 50 days): This is where we systematically cover the entire curriculum using a strategic topic order to maximize comprehension and retention.

- Phase 2: Revision of All 10 Subjects (25 to 30 days): We shift from learning to sharpening. This phase is about rigorous review and targeted practice.

- Phase 3: High-Weightage & Difficult Topics & CFA Level 1 Mock Exams (10 to 15 days): This is the final push, focusing on key areas, simulating the real exam environment, and reviewing summary notes to ensure you walk into the exam calm and confident.

CFA Level 1 90-Day Study Plan & Strategy

Phase 1: Core Concepts in Your CFA Level 1 Study Plan (Weeks 1-9)

This is where you’ll get your hands dirty. These nine weeks are dedicated to methodically working through the CFA curriculum. It requires discipline and a commitment of 40-45 hours of focused study per week.

The Strategic Order of Studying CFA Topics: The ‘Why’ Behind the ‘What’

We won’t tackle subjects randomly. This order is designed for logical progression and psychological advantage.

- Prerequisite – Time Value of Money (TVM) Basics: Before anything else, master TVM using the free prerequisite materials on the Capstone Learnings. This is the bedrock for nearly every quantitative topic and for mastering your financial calculator.

- Financial Statement Analysis (FSA): Start with this heavyweight. It’s lengthy and vital. Conquering it first builds massive momentum.

- Equity Investments: After the FSA marathon, Equity is a slightly easier, yet still critical, topic. It provides a confidence boost.

- Fixed Income: This can be challenging but is incredibly rewarding once the concepts click.

- Derivatives: Tackle this only after you have a solid grasp of Equity and Fixed Income.

- Alternative Investments: Best understood after covering traditional asset classes.

- Portfolio Management: Cover this toward the end, as it integrates concepts from all the investment types you’ve just learned.

- Quantitative Methods: We place it here because the examples make far more sense once you’ve already covered topics like FSA, portfolio mgt, derivatives, etc.

- Corporate Issuers: A relatively straightforward topic that builds on your FSA and TVM knowledge.

Result-Oriented CFA Level 1 Study Plan with Topic-Wise Hours

Here is a strategic schedule to guide your first reading of the curriculum, with recommended hours for each topic.

- TVM: Prerequisite

- FSA: 45 hours

- Equity Investments: 25 hours

- Fixed Income: 35-50 hours

- Derivatives: 25 hours

- Alternative Investments: 8 hours

- Portfolio Management: 45-50 hours

- Quantitative Methods: 35-50 hours

- Corporate Issuers: 25 hours

- Economics: 35-50 hours

- Ethics: 1-2 hours daily

The Ethics Exception in Your CFA Study Plan: A Daily Discipline

Ethics is different. It’s dense, theoretical, and crucial for passing.

- Source is Key: Study Ethics only from the official CFA Institute curriculum & from the right mentor.

- Daily Habit: Dedicate 60-90 minutes every day to reading Ethics. Start this routine immediately.

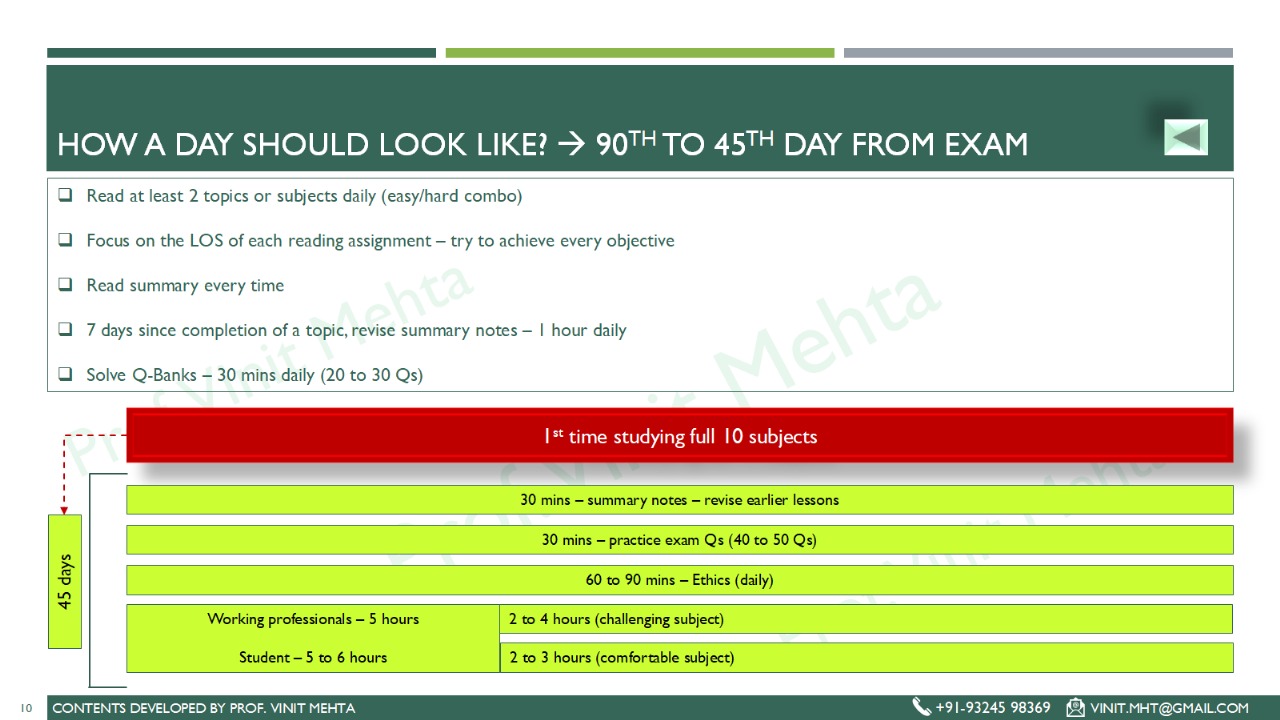

Your Daily Non-Negotiable: The 1-Hour Power Routine

This routine is essential for reinforcing concepts and building the discipline needed for success.

- 30 minutes: Review summary notes and revise earlier lessons.

- 30 minutes: Solve practice exam questions (40 to 50 questions).

- 60 to 90 minutes: Study Ethics (daily).

How to Structure Your Day for CFA Exam Preparation

Phase 2: Intensive Revision & CFA Level 1 Mock Exams (Weeks 10-11)

The Pre-Revision Strategy

Before revising a subject, solve 60-80 practice questions on it cold – mind you the idea is not to know how much you remember or know. This primes your brain to notice how key concepts are tested. After your full review, solve another 60-80 questions to track your improvement toward the 70% target – here the idea is to test yourself.

Mastering CFA Level 1 Mock Exams

In weeks 8-10, you must take at least two full-length CFA Level 1 mock exams.

- Simulate Exam Day: Take both sessions with only a 30-minute break in between.

- Analyze Performance: Thoroughly review every single question right and wrong.

Phase 3: Final CFA Exam Prep & Review (Week 12)

Do not solve any new practice questions or mock exams in the last 7 days. A surprise score can damage your confidence. The time for testing is over. You have already got a very good sense of questions and exam format after solving probably around 3000-5000 questions

The 20-Hour Summary Note Blitz

The entire Level 1 curriculum has roughly 200 pages of summary notes. In the last 2-3 days, your mission is to re-read all of them. This 20-hour task ensures you walk into the exam having reviewed every topic within the last 72 hours.

Resources and Materials for Your CFA Level 1 Preparation

- CFA Institute Curriculum: This is the ultimate source of truth, especially for the Ethics section. While dense, it is the official material the exam is based on.

- Practice Questions & Question Banks (QBanks): Consistent practice is essential. Use QBanks from reputable providers to drill concepts and test your knowledge. Remember the goal: solve a small number every single day.

- Full-Length Mock Exams: CFA Level 1 mock exams are non-negotiable. They are the only way to build stamina, practice time management, and experience the pressure of the real exam day.

- Financial Calculator: Your approved calculator (like the Texas Instruments BA II Plus) is your most important tool. Master its functions early, especially during your TVM practice.

How to Adjust Your Study Plan for a 4-Month Timeline

- Extended Content Acquisition: Dedicate an extra week or two to each major topic area. This allows for more thorough reading and problem-solving without feeling rushed.

- More Review Cycles: You can incorporate an additional review cycle before delving into intense mock exam practice.

- Leisurely Pace for Difficult Topics: Spend more time on topics you find particularly challenging.

- Increased Practice: Integrate even more CFA Level 1 practice questions throughout your study period, not just in the final month. This reinforces learning continually.

Common Mistakes to Avoid in Your CFA Study Plan

- Underestimating the Material: The sheer volume requires consistent, daily effort. Procrastination is your enemy.

- Relying on Rote Memorization: The exam tests application, not just memorization. If you can’t explain a concept in your own words, you don’t know it well enough.

- Neglecting Ethics: This is a high-weightage section and is critical for passing. Give it the daily, dedicated focus it deserves using the official curriculum.

- Do not underestimate Alternative Investments. Students have failed L1 for scoring less than 50% in this topic

- Skipping Mock Exams: You must test yourself under timed, realistic conditions. This is where you learn to manage the clock and your nerves.

- Solving Questions Too Close to the Exam: As mentioned, avoid new questions in the final 10 days. Protect your confidence and focus on high-level review.

Burning Out: The 3-month plan is a marathon at a sprint’s pace. Schedule short breaks, get enough sleep, and maintain your well-being. Don’t be afraid to just open the book on a “bad day,” even if you don’t feel like studying. Consistency builds the habit.

Conclusion: Earning Your Success

By planning backward, following a logical topic order, embracing daily non-negotiable habits, and trusting the revision process, you are not just preparing to pass, you are preparing to excel. Focus on the process, trust your preparation, and walk into that exam room with the confidence that you have truly earned your success. Good luck.