Do you remember the excitement you felt when you registered for the CFA exam? You were motivated, high-spirited, and ready to start a new chapter in your life. But for many candidates, that initial excitement is soon followed by a wave of questions: Where do I start? What is the right order of topics? How many hours do I need? How many revisions are enough?

If you have 120 days (or 4 months) until your exam, you are in a strong position. This timeline allows for a deep, comprehensive, and less rushed preparation. This is not just another schedule; this is an expert-led strategy designed to take you beyond simply passing and place you in the top 10% of candidates.

Why This CFA Level 1 Study Plan Aims for the 90th Percentile

Let’s be clear about our objective. The CFA L1 exam can be scored in the range of 1,000 to 1,900. The “Minimum Passing Score” is 1,600.

However, our strategy isn’t about scraping by. It’s about aiming to be WAY above the Minimum Passing Score of 1600. This is achieved by mastering the material to a level where you are consistently scoring over 70% on practice questions in every single subject. When you reach that level of proficiency, the pass rate becomes irrelevant. You are not competing with the pass rate; you are competing to be one of the best-prepared candidates in the room. This 4-month CFA Level 1 study plan is your roadmap to get there.

Understanding Your CFA Exam Format & Structure of the Test

To prepare effectively, you must know what you’re preparing for. The CFA Level 1 exam consists of two sessions on the same day:

- Session 1 & Session 2: Each session is 2 hours and 15 minutes long.

- Total Questions: There are 180 multiple-choice questions in total (90 per session).

- Topic Distribution: The 10 subjects are split between the two sessions.

- Session 1: Features a dedicated section for Ethical and Professional Standards. The other four subjects (like Quantitative Methods, Economics, FSA, and Corp. Fin.) will have their questions jumbled together. You won’t know which subject a question is from until you read it.

- Session 2: Features a dedicated section for Portfolio Management. Similarly, the questions for the remaining four subjects (like Equity, Fixed Income, Derivatives, and Alternative Investment) will be in a random, jumbled order.

- The 30-Minute Break: You will have an optional 30-minute break between sessions. Take it. Your mind needs this time to reset and refresh. Don’t make the mistake of skipping it, no matter how well your first session went.

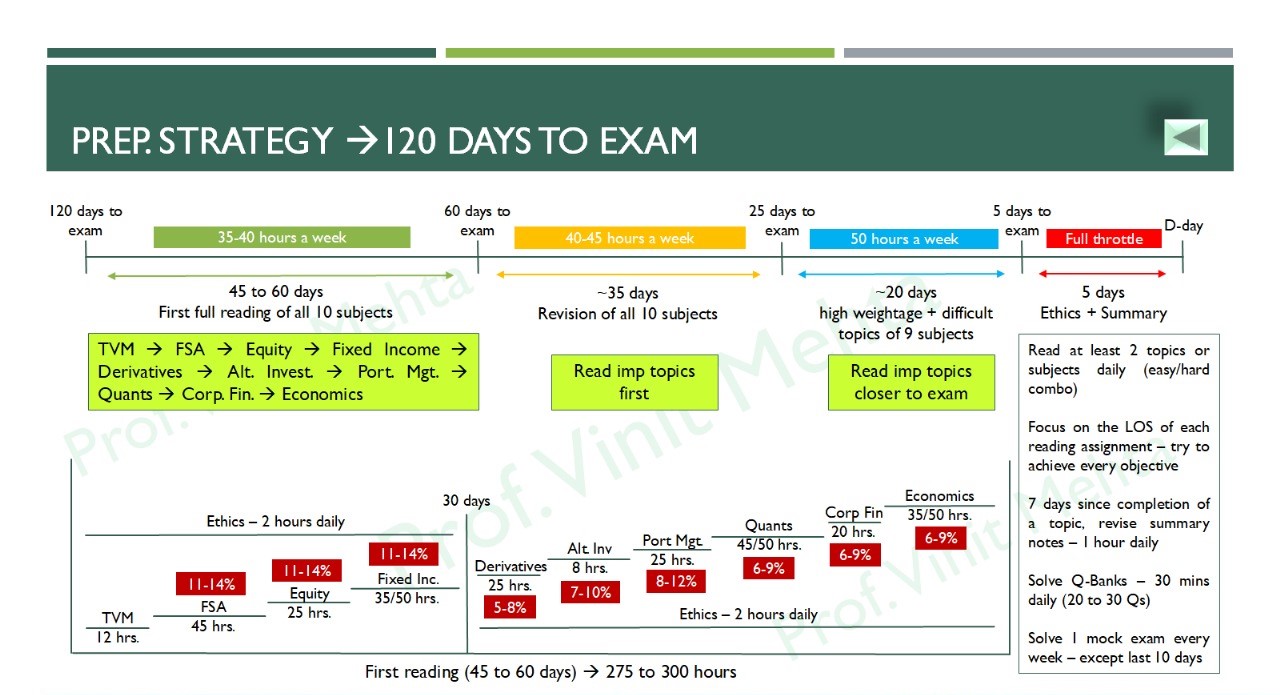

The 120-Day CFA Plan (4-Month): The 3-Phase Framework

Our 120-day journey is broken down into three distinct phases, moving from broad learning to targeted mastery. This plan requires a total commitment of roughly 250-300 hours of self-study.

- Phase 1: The First Reading & Core Knowledge Build (First 60 Days)

- Phase 2: The First Intensive Revision (Next 35 Days)

- Phase 3: The Final Revision & Mastery (Last 25 Days)

Phase 1: CFA Core Topic Preparation (First 60 Days)

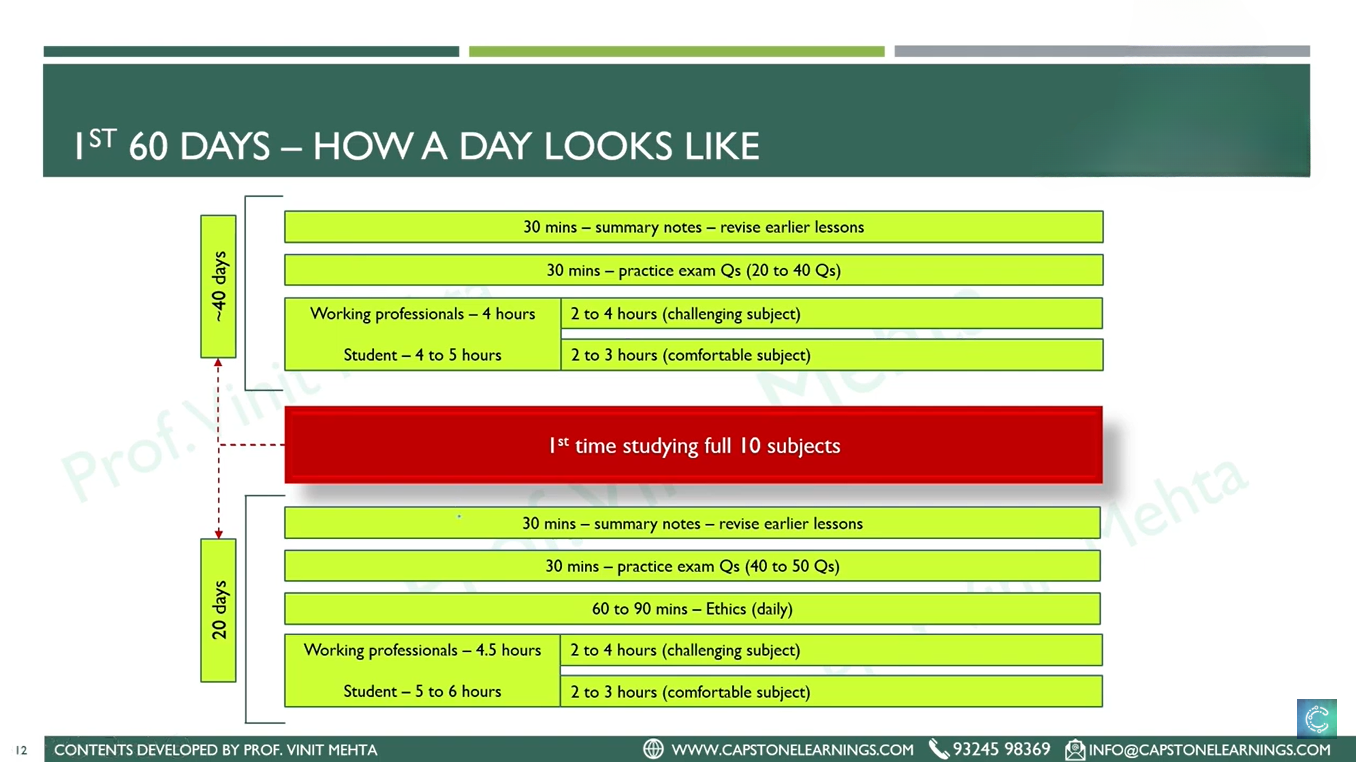

Weekly Commitment: Aim for 35-40 hours per week. For working professionals, this may mean 4 hours on weekdays and more on weekends.

The Strategic Topic Order: We will not tackle subjects randomly. This order is designed for logical progression and psychological advantage, starting with the most important and foundational topics first.

- Prerequisite – Time Value of Money (TVM) Basics (12 Hours): Before anything else, master TVM. This is the bedrock for nearly every quantitative topic and is crucial for learning your financial calculator.

- Financial Statement Analysis (FSA) (45 Hours): Start with this heavyweight. It’s lengthy and vital. Conquering it first builds massive momentum.

- Equity Investments (25 Hours): After the FSA marathon, Equity is an easier, yet still critical, topic that provides a confidence boost.

- Fixed Income (40 Hours): A challenging but fascinating subject that builds directly on your TVM skills.

- Derivatives (20 Hours): Tackle this only after you have a solid grasp of Equity and Fixed Income.

- Alternative Investments (8 Hours): One of the shortest subjects, best understood after covering traditional asset classes.

- Portfolio Management (20 Hours): Cover this toward the end, as it integrates concepts from all the investment types you’ve just learned.

- Quantitative Methods (35 Hours): We place it here because the examples (like forecasting EPS) make far more sense once you’ve already covered topics like FSA, connecting the statistics directly to finance.

- Corporate Issuers (20 Hours): A relatively straightforward topic that builds on your FSA and TVM knowledge.

- Economics (35 Hours): This topic has few connections to the others and can be slotted in here.

The Ethics Exception (60 Hours Total): Ethics is the driest and one of the most important subjects. Do not cram it.

- The Golden Rule: Study Ethics only from the official CFA Institute curriculum.

- The Daily Habit: Dedicate 90 minutes to 2 hours every day to reading Ethics. Start this parallel routine about three months before your exam. By covering one standard a day, you will master it without burnout.

Your Daily Non-Negotiable 1-Hour Power Routine: This is the secret to continuous reinforcement.

- 30 Minutes – Review Summary Notes: Each day, re-read the summary notes of a subject you’ve already completed. This fights the “forgetting curve.”

- 30 Minutes – Solve Practice Questions: Spend 30 minutes solving 15-20 practice questions from another subject. Over 100 days, this adds up to 2,000 questions!

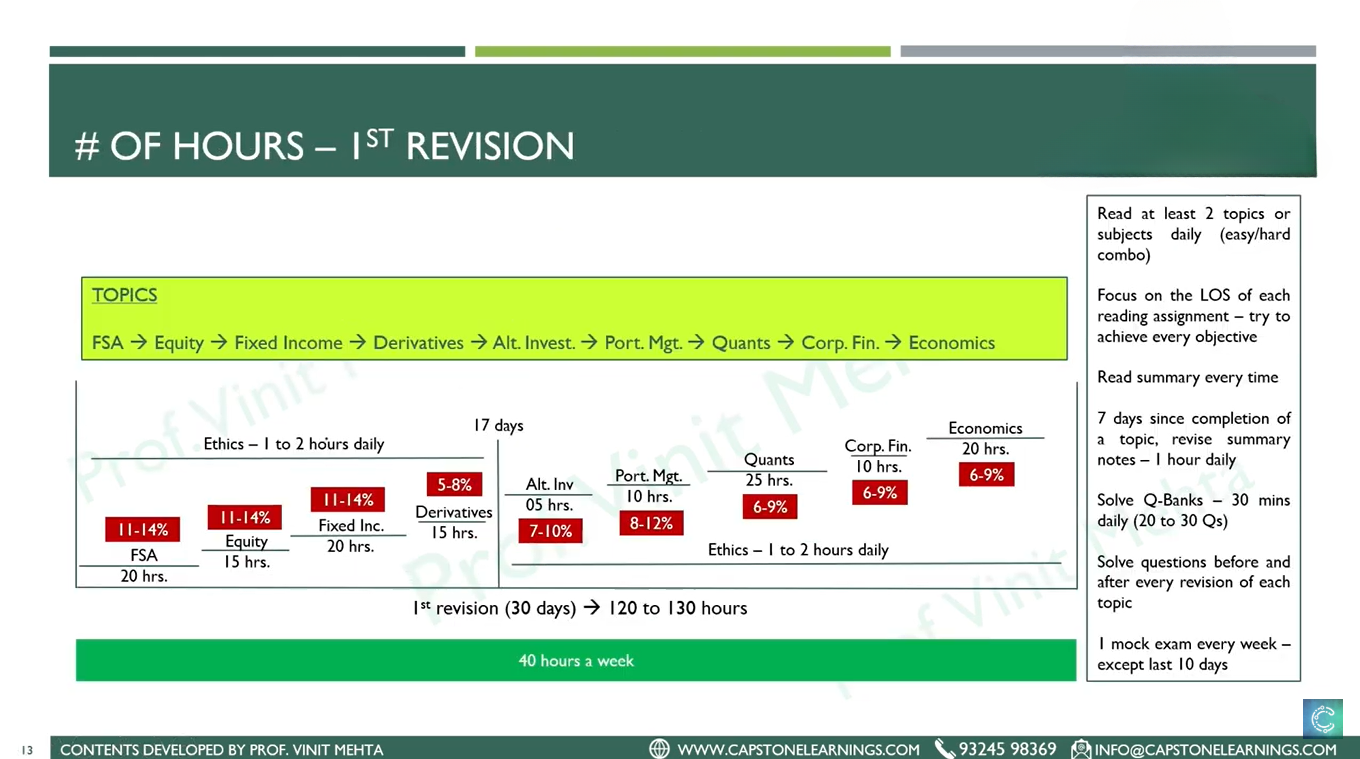

Phase 2: Intensive CFA Revision Strategy (Next 35 Days)

Weekly Commitment: Step it up to 40-45 hours per week.

The Pre-Revision Strategy: Before starting your revision of a subject (e.g., FSA), solve 60-80 practice questions on it cold. The goal isn’t a perfect score; it’s to prime your brain. As you revise, your mind will automatically flag the concepts tested in those questions, telling you exactly how to focus your attention.

After your full review of the subject, solve another 60-80 questions to gauge your improvement. Your target score should be moving from the 50% range toward that 70% mark.

Phase 3: Final Review and Mastery (Last 25 Days)

Weekly Commitment: This is the peak. Aim for 50 hours per week. This is where weekends become essential.

A Shift in Topic Order: In this final revision, you should reverse the order slightly. Study the most important and difficult topics closer to the exam to maximize short-term memory.

- Start with: Easier subjects like Corporate Issuers and Alternative Investments.

- End with: Heavyweights like FSA, Fixed Income, Equity, Derivatives, and Ethics.

Final Week Strategy for the CFA Level 1 Exam

- The “Pencils Down” Rule: Do not solve any new practice questions or mock exams in the last 10 days before the exam. A surprise score can destroy your confidence. The time for testing is over; the time for consolidation has begun.

- The 20-Hour Summary Note Blitz: The entire Level 1 curriculum has roughly 200 pages of summary notes. In the last 2-3 days, your mission is to re-read all of them. At a pace of 10 pages per hour, this is a 20-hour task. This will boost your confidence and short-term memory, putting you “in a different orbit altogether” on exam day.

Effective Strategy for CFA Level 1 Practice Questions & Mock Exams

- Your Benchmark: You should be able to correctly solve 70% of questions for every subject.

- The Ultimate Test: Can you explain each concept or Learning Outcome Statement (LOS) in your own words? If you can, you’ve understood it, not just memorized it.

- Analyze Your Mistakes: Every time you get a question wrong, diagnose the reason. Was it:

- A Concept Gap? You didn’t understand the underlying material.

- Poor Reading? You missed a key word like “least” or “not.”

- Poor Interpretation? You misunderstood what the question was truly asking (e.g., “least inappropriate” means “most appropriate”).

By following this expert-designed 120-day study plan for the CFA Level 1 exam, you are not just preparing to pass. You are building a foundation of knowledge and discipline that will serve you throughout your entire CFA journey and your career. If you need any personalized mentorship on how to plan your CFA study plan get a 1on 1 free consultation.