Ever wondered how close you really were to passing your CFA exam result? Was it a single question or a whole topic area? Until now, the answer felt like a mystery.

Starting with the February 2025 exams, the CFA Institute is giving you a clearer picture. The CFA exam result is getting an upgrade with two new, crucial data points. This change helps you stop guessing and start strategizing for your next attempt. Let’s break down how to interpret your CFA exam result and turn that information into a killer study plan.

What’s New in CFA Result Display

Forget the vague ‘pass/fail’ email. Your updated CFA exam result now includes two essential additions to help you perform a proper CFA exam score analysis:

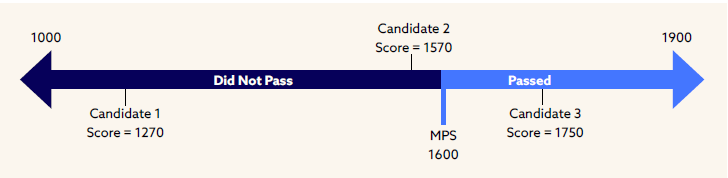

- Value of Minimum Passing Score (MPS): You will see the precise, standardized score that the Board of Governors determined was required to pass the exam.

- Your Actual Score in the Exam: You now get the exact standardized score you earned on the exam.

This is a game-changer. For the first time, you can directly compare your score to the Minimum Passing Score CFA set for that specific exam.

Why the CFA Result Update Matters for Students

This change is all about practical, actionable feedback for students—whether you passed or fell short this time. Knowing these scores helps you answer the most critical questions after results day:

- Know How Close/Far You Are:

You can now objectively determine exactly how close or far you were from the MPS. No more vague feelings—you get a number that quantifies the gap. - Decide Effort Needed for Next Attempt (if you didn’t pass):

A small gap means you just need targeted, minor adjustments. A large gap means you need a full re-evaluation and more intense effort to cross the line. This prevents wasted time or unnecessary panic. - For Those Who Passed – Level Up Smartly:

Even if you cleared the exam, this data isn’t just a “nice to know” — it’s a strategic advantage.

- If your score was only slightly above the MPS, it signals that you should tighten your grip on weak areas before moving to the next level.

- If you scored well above the MPS, you can analyze which study methods worked best and double down on those for the next stage.

- Understanding your relative strength across topics helps you build a stronger foundation for higher-level concepts, especially since each CFA level builds on the previous one.

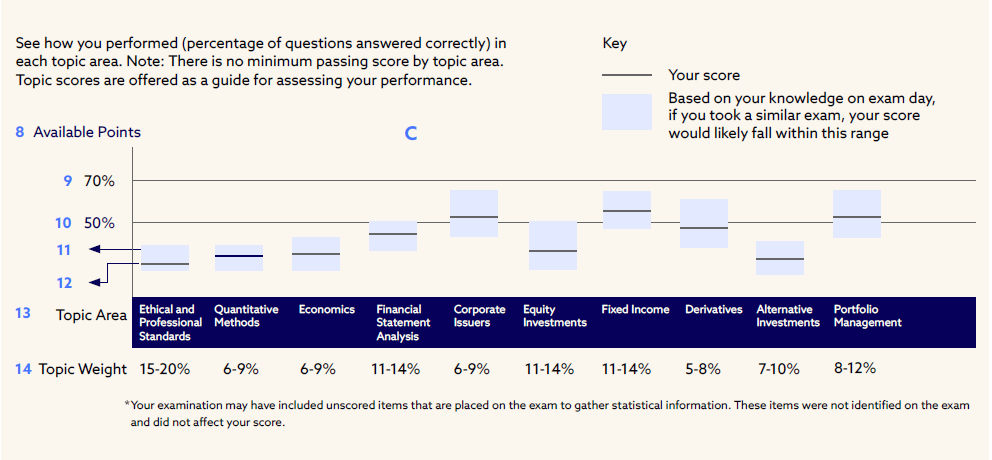

- Identify Weak Areas:

This score, combined with the existing subject-wise performance breakdown, tells you exactly which area to focus on. If your score was close to the MPS, you can focus on mastering the two or three topics where your performance was lowest.

This new level of transparency makes your CFA performance analysis simple and effective. It helps you shift from simply studying harder to studying smarter—whether you’re preparing for a retake or gearing up for the next level.

What’s No Longer There In CFA Result Report

So, forget chasing the percentile. Honestly, that number never helped you pass anyway. The decision was always binary: did you meet the MPS? Now you have the tools to focus on what really matters—your score versus the MPS. Keep it simple and focus on the data that directly influences your CFA exam pass/fail calculation.

CFA Scale Scores – Quick Overview

| CFA Level | Min Score | Minimum Passing Score (MPS) | Max Score |

|---|---|---|---|

| Level 1 | 1000 | 1600 | 1900 |

| Level 2 | 2000 | 2600 | 2900 |

| Level 3 | 3000 | 3600 | 3900 |

Common CFA Result Misconceptions

- You might be tempted to Calculate Percentage Scores: For example, calculating 1600/1900 to get 84.2% or 600/900 to get 67% is wrong.

- You might be tempted to compare MPS vs. Max Score for an Approximate Percentage: For Level 2, calculating 2600/2900 is also wrong.

- You might be tempted to Judge Pass/Fail Based on Scale Scores: The scores themselves don’t directly tell you your raw percentage.

The Reality: The Modified Angoff Method

The Key Takeaway: The scores of 1600, 2600, and 3600 are standardized. They do not represent a raw percentage of 84.2% or any other simple fraction. The pass/fail decision is always based on whether you correctly answered the minimum number of items determined by the Board of Governors. You absolutely don’t need to stress about the math behind this conversion. It’s beyond your control.

Focus on What You Can Control in CFA Exam Preparation

Frankly, no point getting into details of things that are anyways beyond your control. Here’s what you can control and what you must focus on:

- Master Every Concept: Your primary focus should be on deep conceptual clarity and practice, practice, practice.

- Aim for 70%+ in Each Topic: The 70% benchmark is the historical, unwritten rule for success. If you’re consistently hitting that in your practice exams across all subjects, you’ll easily clear the MPS.

- Plan Smarter, Not Harder: Use the new score information—your score vs. the MPS—to plan your next attempt. Did you miss it by 50 points? Then focus relentlessly on the three topics where your subject-wise breakdown shows the lowest performance. That minor boost is all you need.

Let’s do that! That’s the only way to guarantee success on your next CFA exam result.

Conclusion

The new transparency in the CFA exam result is a massive win for students. You now have the Minimum Passing Score and your actual CFA exam score to guide your CFA exam score analysis. Stop agonizing over how close you were. Use the data, combine it with your subject-wise breakdown, and create a targeted, focused study plan. Embrace the clarity. Now, go conquer that study material!