CFA Level 1 Online Classes

Our CFA Level 1 online classes are designed for students and working professionals who want clear concepts, structured exam preparation, and expert-led live sessions. This program is ideal for aspirants looking for the best online classes for CFA Level 1, combining conceptual clarity with exam-focused strategies.

With real-world examples, recorded lectures, mock exams, and personalized mentoring, our CFA online classes help you prepare confidently for the CFA Level 1 exam.

Start your CFA prep now!

Download Brochure

Advantages Of CFA Level 1 Online Course

Start your CFA prep now!

Our Offerings for CFA® Level 1 Aspirants

Additional Key Features

Why Choose Our CFA Level 1 Online Coaching

Start your CFA prep now!

Student Success Stories & Testimonials

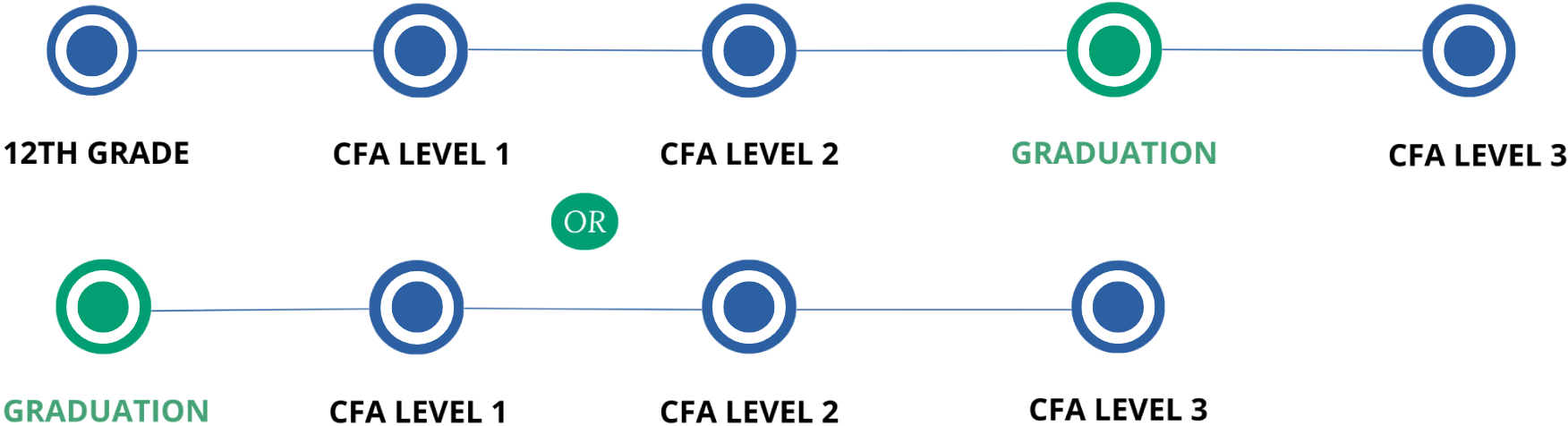

Eligibility Criteria for CFA

- You must be an undergraduate student.

- Your selected exam window must be within 23 months before your graduation month.

- You must complete your degree before appearing for the Level III exam.

Become CFA in 2 years

CFA Subject-Wise Weightage

| Topic | Structure | Level 1 | Level 2 | Level 3 |

|---|---|---|---|---|

| Ethical & Professional Standards | Ethical rules for Governance of the Financial Institute while dealing with various persons | 15 – 20% | 10 – 15% | 10 – 15% |

| Quantitative Methods | Application of Statistical tools in financial analysis | 6- 9% | 5 – 10% | – |

| Economics | Applied economics for Financial Decision Making | 6 – 9% | 5 – 10% | 5 – 10% |

| Financial Statement Analysis | Reporting Standard & Accounting Analysis | 11 – 14% | 10 – 15% | – |

| Corporate Finance | Tools for the Financial Management of a Company | 6 – 9% | 5 – 10% | – |

| Equity Investments | Analysis & Valuation of Shares & similar Securities | 11 – 14% | 10 – 15% | 10 – 15% |

| Fixed Income | Analysis & Valuation of Bonds & similar Securities | 11- 14% | 10 – 15% | 10 – 15% |

| Derivatives | Analysis & Valuation of Derivative Instruments | 5 – 8% | 5 – 10% | 5 – 10% |

| Alternative Investments | Analysis & Valuation of Mutual Fund, PE Fund, VC Fund, Commodity & other investments | 7 – 10% | 5 – 10% | 5 – 10% |

| Portfolio Management | Portfolio Management theories & their Application | 8 – 12% | 5 – 10% | 35 – 40% |

CFA Exam and Fee details

| Criteria | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Number of Exams | 2 exams in a single day | 2 exams in a single day | 2 exams in a single day |

| Time Duration | 2.25 Hours per Exam | 2.25 Hours per Exam | 2.25 Hours per Exam |

| Number of Questions | 90 MCQ’s Per Exam | 44 Vignette-Based MCQs | 11 Vignette-Based MCQs & Essay |

| Question Type | MCQs | Vignette-Based MCQs | Vignette-Based MCQs & Essay |

| Marking System | Approx. 70% to Clear (no negative marking) | Approx. 70% to Clear | Approx. 50% to Clear |

| Exam Month | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| February | ✔ | – | ✔ |

| May | ✔ | ✔ | – |

| August | ✔ | ✔ | ✔ |

| November | ✔ | – | – |

| Fee Type | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Early Registration Fee | $1,140 + GST | $1,140 + GST | $1,240 + GST |

| Standard Registration Fee | $1,490 + GST | $1,490 + GST | $1,590 + GST |

CFA Registration deadlines

| Exam Attempt | February | May | August | November |

|---|---|---|---|---|

| Early Registration | July | October | January | April |

| Standard Registration | November | February | May | August |

| Exam Attempt | February | May | August | November |

|---|---|---|---|---|

| Early Registration | July | October | January | April |

| Standard Registration | November | February | May | August |

CFA Scholarship Program

| Scholarship | Eligibility | Fee Reduction To |

|---|---|---|

| Access Scholarship | For those with financial need | USD 400 |

| Student Scholarship | Current students at affiliated universities | USD 600 |

| Professor Scholarship | Full-time professors or department heads | USD 600 |

Frequently Asked Question

Most students require 250–300 hours of focused study for CFA Level 1.

The best CFA coaching is one that offers expert faculty, structured study plans, and high exam-oriented content.

Completing all three levels typically takes 2.5–3 years, depending on your pace.

CFA Level 1 pass rates generally range around 35–45% globally.

Kickstart Your CFA Journey

Learn the right way with expert-led guidance and proven study methods.

Start your CFA prep now!